Editor:Albert

Data:30/9/2024

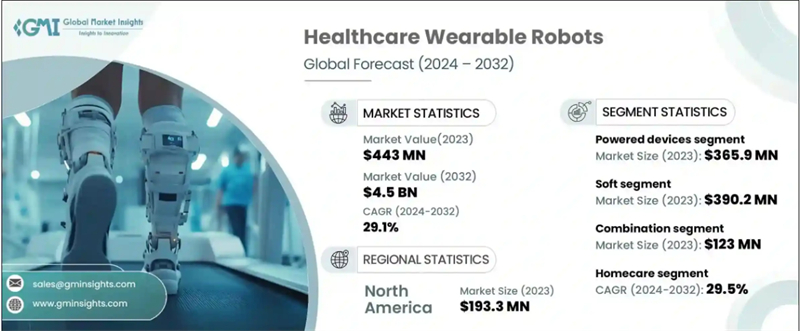

The medical wearable robots market will be valued at USD 443 million in 2023 and is expected to grow at a CAGR of 29.1% between 2024 and 2032. The high growth of the market is mainly attributed to the rising incidence of disability, increasing focus on patient independence, supportive government initiatives and funding, and growing interest in exoskeletons.

Understand key market trends

As healthcare spending increases and the need for innovative rehabilitation solutions increases, healthcare facilities are increasingly adopting exoskeletons. This trend is encouraging greater investment from the public and private sectors to advance technologies that improve mobility and patient outcomes. For example, in June 2024, Ekso Bionics Holdings, Inc. announced that it had signed a research partnership with Shepherd Center, a rehabilitation hospital in Atlanta, USA. The partnership will enable the company to integrate its Ekso Indego and EksoNR devices into all rehabilitation and community network centers to provide better patient support.

Healthcare Wearable Robots Market Trends

Technological advances have led to more effective, personalized and widely adopted medical wearable robots, improving patient outcomes in mobility assistance and rehabilitation settings.

Wearable robots collect extensive patient data, including movement patterns, muscle engagement and rehabilitation progress. This data is analyzed using advanced analytics to fine-tune treatment options and optimize robot performance based on individual needs.

Wearable robots are increasingly integrated with wireless technology and the Internet of Things (IoT), enabling real-time sharing of data with healthcare providers. This facilitates remote monitoring, progress tracking, and adjustment of treatment plans.

Additionally, advances in battery technology such as high-energy-density lithium-ion batteries allow wearable robots to run longer on a single charge, making them more suitable for daily use. Some robots also use regenerative braking systems to recover energy. The lightweight, efficient power system keeps the device smaller, improving portability and ease of use.

Healthcare Wearable Robot Market Analysis

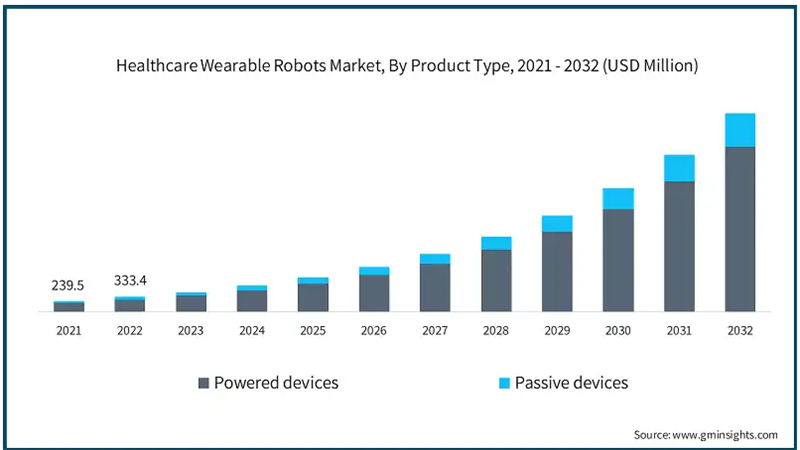

Based on product type, the market is segmented into active devices and passive devices. The Active Equipment segment generated the highest revenue in 2023 at $365.9 million.

On the basis of structure, the medical wearable robots market is divided into soft and hard categories. The soft segment dominates, with a 2023 value of $390.2 million.

On the basis of material, the medical wearable robots market is segmented into composite, 3D printed, metal, plastic, and other materials. The portfolio segment accounts for the major revenue share and was worth $123 million in 2023.

On the basis of body part, the medical wearable robot market is segmented into lower body, upper body, and full body. The lower body segment holds the majority of the market share and was valued at USD 327.4 million in 2023.

On the basis of application, the medical wearable robots market is segmented into stroke, spinal cord injury, traumatic brain injury, and other applications. Stroke segment dominates the segment and was valued at USD 235.3 million in 2023.

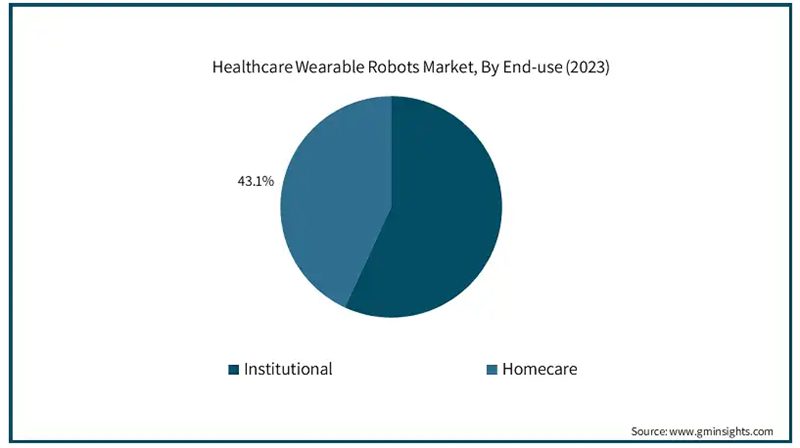

On the basis of end use, the medical wearable robots market is segmented into institutional care and home care. The home care segment holds a significant share and is expected to witness higher growth at a CAGR of 29.5% during the forecast period.

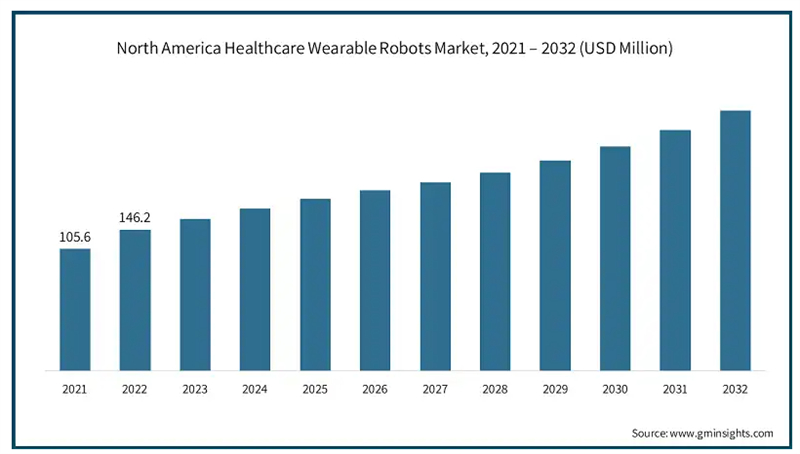

The North American medical wearable robots market market revenue was valued at USD 193.3 million in 2023 and is expected to grow at a CAGR of 28.4% during the period 2024 to 2032. · Rehabilitation and mobility support are key areas of concern in North America, particularly with high rates of injuries related to sports, accidents and workplace incidents. Wearable robots are increasingly used in rehabilitation clinics and hospitals to help patients regain motor function after trauma or surgery. ·The healthcare industry in North America is turning to home care and outpatient rehabilitation to relieve the burden on hospitals and reduce healthcare costs. Wearable robots enable patients to continue their recovery at home, promoting faster recovery and increasing patient independence. Additionally, demand for home wearable robots is surging, especially as healthcare systems seek to enhance remote patient monitoring and provide personalized care in the home environment.

The U.S. medical wearable robot market market revenue was valued at USD 174.6 million in 2023 and is expected to maintain substantial growth between 2024 and 2032. ·The United States has a high number of stroke cases and neurological disorders such as multiple sclerosis, spinal cord injuries, and cerebral palsy, which often lead to long-term disability. Wearable robots are widely used in rehabilitation programs to help patients regain motor function and mobility, driving the demand for these devices. · Additionally, the U.S. Veterans Health Care Program has also played a role in driving demand for wearable robots, as many military personnel require rehabilitation and assistive devices after retirement due to injury or disability. The UK medical wearable robot market is expected to grow significantly over the next few years.

Japan dominates the Asia-Pacific medical wearable robot market.

As the number of patients requiring physical rehabilitation continues to increase, the demand for rehabilitation robots in Japan is also increasing. Wearable rehabilitation robots are used in physical therapy to help patients improve motor skills, especially after surgery, injury or neurological events such as stroke.

These robots can deliver customized treatments, with some offering adjustable settings to meet the specific needs of individual patients, thereby increasing the effectiveness of the rehabilitation process.

Hospitals, rehabilitation centers, and elderly care facilities are increasingly adopting wearable robots as a part of their healthcare delivery model, thereby boosting market growth.

Post time: Sep-30-2024